What happens to your cryptocurrency when you’re no longer around to manage it?

Unlike traditional assets that flow through established inheritance channels, crypto exists in a digital wilderness where seed phrases and private keys—not death certificates—determine who gets access to the funds.

Without proper planning, your digital fortune could vanish into the blockchain ether forever.

Creating a thorough inventory is the first essential step.

This means documenting every coin, token, and wallet you own—whether it’s Bitcoin lounging in cold storage or that speculative NFT collection you bought during last year’s hype cycle.

Think of this inventory like a treasure map, except instead of “X marks the spot,” it’s “seed phrase accesses the millions.”

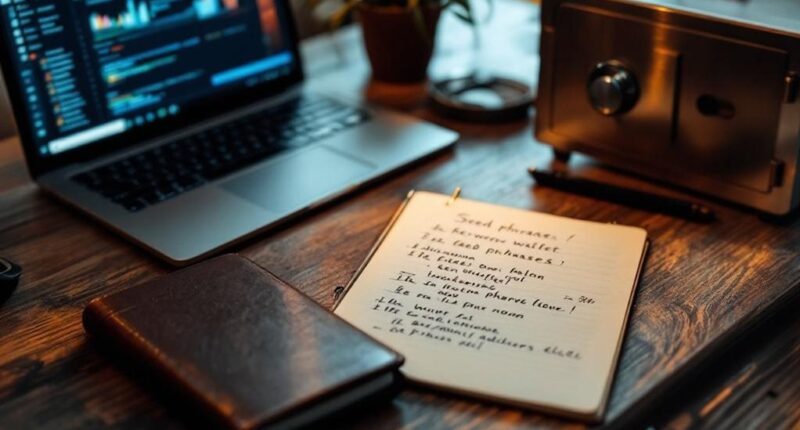

Secure storage solutions balance the competing demands of security and accessibility.

Finding the sweet spot between uncrackable security and practical access is crypto’s most delicate balancing act.

Hardware wallets stored in fireproof safes offer protection, but excessive paranoia can backfire spectacularly.

One crypto millionaire’s elaborate hiding system—with components scattered across three countries—resulted in his heirs accessing precisely zero of his fortune.

A metal backup of seed phrases provides protection from both hackers and household disasters.

Many investors now recognize that unlike traditional accounts where you can simply name direct beneficiaries, cryptocurrency requires more elaborate inheritance planning.

Legal considerations shouldn’t be overlooked.

Even with perfect technical documentation, exchanges often demand death certificates and legal authority before releasing funds.

Consider including clear instructions about accessing both hot and cold wallets as part of your comprehensive digital estate plan.

Understanding that hot wallets offer convenience for frequent transactions while sacrificing some security can help your beneficiaries make informed decisions about fund management after your passing.

Specialists in crypto estate planning can navigate these requirements, ensuring your digital assets don’t become digital fossils.

Regular security updates serve as a digital insurance policy.

The crypto landscape evolves faster than smartphone models, making yesterday’s security measures potentially obsolete today.

Testing recovery procedures with designated beneficiaries creates a “fire drill” for your digital assets.

Perhaps most importantly, education bridges the knowledge gap between crypto enthusiasts and their less tech-savvy loved ones.

The most meticulously crafted recovery plan fails if beneficiaries can’t distinguish a legitimate wallet from a phishing attempt.

Explaining basic concepts transforms intimidating technical jargon into manageable instructions.

With thoughtful planning, your crypto assets can seamlessly transfer to the next generation rather than becoming permanently locked in blockchain limbo—a fitting legacy for any digital asset enthusiast.